Healthcare expenses are the number one cause of bankruptcies in the United States.

Even the most financially prudent individual can lose their economic stability when faced with the high costs resulting from a catastrophic illness or accident. Bankruptcy is a legal process that allows you to:

- Recover from debt caused by unpaid medical bills.

- Address the high cost of caring for an elderly or disabled loved one.

- End healthcare debt collections activities.

- Rebuild your credit.

- Focus on regaining your health.

MEDICAL BANKRUPTCY

Although there are many factors that contribute to medical debt – rising insurance costs, lost wages, high out-of-pocket expenses for co-pays, medical supplies, prescription drugs, unreimbursed expenses for medical treatments and surgeries – medical expenses are usually involuntary and unplanned. Medical bankruptcy can help you recover from debt caused by unpaid medical bills.

Can Medical Bills Be Forgiven?

Getting in touch with the billing department of your hospital or clinic may enable you to get a discount on your medical bills. Some hospitals have medical debt forgiveness programs, such as financial aid programs, for patients who qualify. Additionally, many medical providers offer interest-free payment plans for patients who are not able to pay in full right away. Taking withdrawals against credit cards or cashing out savings or retirement accounts to pay medical bills can destroy your finances and negatively impact your ability to save for the future.

Bankruptcy is a legitimate financial tool that can offer relief in the face of overwhelming medical debt. Medical debt is classified as unsecured debt, and it will often be forgiven in a personal bankruptcy case. This often includes any medical expenses placed on a credit card.

How Do I Know If Filing For Medical Bankruptcy Is The Best Option?

Some of the biggest mistakes people make are to ignore hefty medical bills or to just want too long to get help. It is understandable to feel overwhelmed by a difficult financial situation, but delaying action will only serve to increase interest fees and add to the number of weeks or months you are in arrears. If you are struggling with medical debt, make time to meet with an experienced local bankruptcy attorney, so that you can weigh all of your options. Bankruptcy can be a sensible course of action during times of extreme financial distress. Contact Sirody & Ruben Bankruptcy Center at 410-415-0445 for more information about filing for medical bankruptcy. Our trusted bankruptcy attorneys will take the time to understand your individual situation and outline all available options. We understand that you want to hold onto your home and other valuable assets. We have filed thousands of Maryland bankruptcy cases, giving us the experience to develop the best strategy for your particular situation.

Get The Help You Need

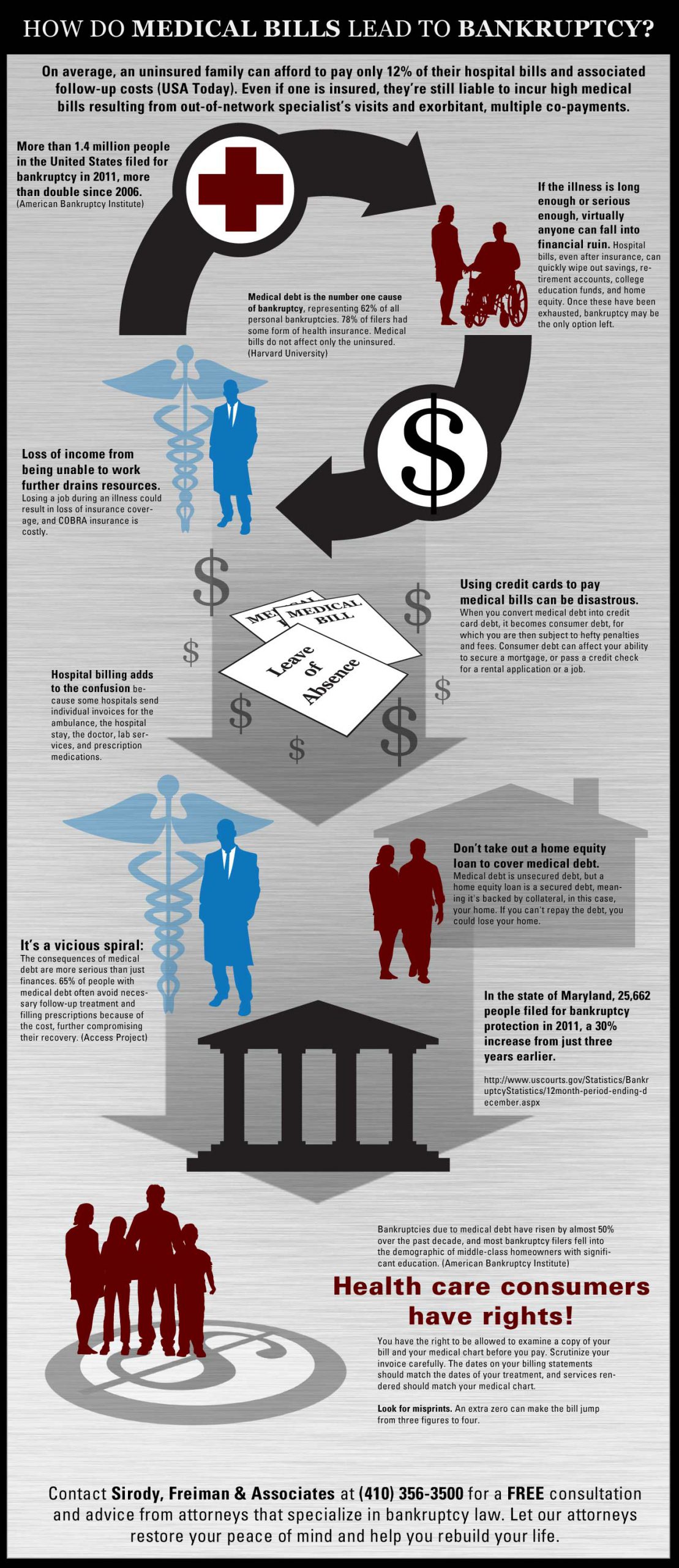

The infographic on this page illustrates how medical bills can lead to an overwhelming spiral of growing debt.

Download Infographic

IF YOU ARE STRUGGLING WITH MEDICAL DEBT, YOU ARE NOT ALONE.

According to the Kaiser Family Foundation, 65% of Americans list unexpected medical expenses as their top financial concern. This comes at a time when the average unpaid medical debt in the US has increased to nearly $6,000. Our trusted medical bankruptcy attorneys can help restore your peace of mind.